Contents:

What does a harami tell us about the condition of the market? During a bullish move, the harami candlestick indicator tells us that strength in the previous candle is dissipating. Like other candlestick patterns, the Harami can signal that a reversal may be at hand. This article will focus on these patterns and how to trade them. The Harami candlestick pattern is usually considered more of a secondary candlestick pattern. These are not as powerful as the formations we went over in our Candlestick Patterns Explained article; nonetheless, they are important when reading price and volume action.

What is a Marubozu Candlestick?

A Marubozu Candlestick pattern is a candlestick that has no “wicks” (no upper or lower shadow line). A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish.

The bulls have been in control, only for it to switch to uncertainty. The second candle is normally a spinning top or neutral dojo which suggests uncertainty. The bears have shifted from being dominant in candle one to being uncertain in candle two. If this swing in sentiment continues there will likely be confirmation in candle three.

Bearish Harami Candlestick: Three Trading Tidbits

A Doji candlestick is not signaling a trend change or something like that. It is just a sign of the uncertainty on the market as star Doji doesn’t have any elements except the hollow body candle itself. The harami cross is different because it has two candles, meaning that this pattern indicates a trend direction and shows a possible reversal. A bullish harami is made of a large bullish candlestick that is followed by a small bearish candlestick. On the other hand, a bearish harami is made up of a large bearish candle that is followed by a small bullish candle. The candlestick is made up of two candle that happen when a bullish or bearish trend is about to end.

Stock Market Highlights: Nifty forms indecisive Bullish Harami candle; what does it signal for Tuesday's … – Economic Times

Stock Market Highlights: Nifty forms indecisive Bullish Harami candle; what does it signal for Tuesday's ….

Posted: Mon, 16 May 2022 07:00:00 GMT [source]

When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. The frequency rank is 26 and that means you will be able to find plenty of bearish harami's in a historical price series. Whether or not it is worth the hunt I will leave up to you. The homing pigeon candle is similar to the bullish harami.

#1 – Trading Harami with Price Action

The bullish harami candlestick functions almost randomly with reversals taking a slight edge over continuations by 53% to 47%. That means you probably can't guess the breakout direction with any accuracy. The frequency rank is 25, which means the candle pattern should be plentiful in a historical price series. The overall performance rank of 38 is decent but not outstanding. The name “Harami” comes from Japanese and means pregnant due to the fact that the formation is similar in appearance to a pregnant woman.

Below, we are going to show you how to confirm the bullish harami pattern and find good entry and exit levels by using the RSI, MACD, and Fibonacci ratios. One point to note is that these four trading strategies can be used in combination with all other candlestick reversal patterns. The first black arrow shows an increase of IBM and price interaction with the upper bollinger band. If you have an uptrend and you get a bearish harami candle, try confirming this signal with the stochastic. In this case, you will need an overbought signal from the stochastic.

How Do You Trade on a Bearish Harami?

The word ‘https://g-markets.net/‘ in Japanses language means ‘pregnant’. A look at this bullish harami cross pattern formed by the two candles represents a woman carrying a baby, hence the name. The first red-colored long bearish candle is often called the ‘mother candle’, while the second short-sized doji candle is often called the ‘baby candle’. The bullish harami cross candlestick is formed by two adjacent candles.

- Bullish harami candle gains significance when formed during the downtrend.

- A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish.

- Identifying the bullish harami pattern on a trading chart is fairly straightforward and easy.

- The Harami Candlestick Pattern is considered a trend reversal pattern that can either be bullish or bearish, depending on the direction of the price action.

That's the reason a third confirmation candle is required to be absolutely sure that the bullish pattern is now initiated and has a good chance that it may continue for some time. Bullish and bearish haramis are among a handful of basic candlestick patterns, including bullish and bearish crosses, evening stars, rising threes, and engulfing patterns. A deeper analysis provides insight using more advanced candlestick patterns, including island reversal, hook reversal, and san-ku or three gaps patterns.

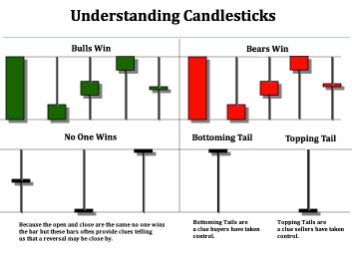

Two candles of opposite colors doesn’t always mean a reversal. Lets say in a down trend, when P2 opens higher than P1’s close and closes higher than the P1’s open, it doesn’t come under any of the reversal patterns. A bullish Harami occurs at the bottom of a downtrend when there is a large bearish red candle on Day 1 followed by a smaller bearish or bullish candle on Day 2. A candlestick chart typically represents the price data of stock on a single day, including opening price, closing price, high price, and low price. A breakout, by the way, is a close either above the top of the candlestick pattern or below the bottom of it.

Which candlestick pattern is most reliable?

According to the book Encyclopedia of Candlestick Charts by Thomas Bulkowski, the Evening Star Candlestick is one of the most reliable of the candlestick indicators. It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend.

The upward candle is then followed by a doji which, similarly to before, must be within the previous candle’s length. It represents indecision from the buyers and potential change of momentum because the doji “gaps” open closer to the mid-range of the previous candle. CharacteristicDiscussionNumber of candle linesTwo.Price trend leading to the patternDownward.ConfigurationLook for a tall black candle in a downward price trend.

The Harami Cross has a very small real body, almost like a Doji. This is important to qualify as a Harami cross–the smaller the real body, the better it is. A sideway trend is when the stock gets stuck in a range. In Harami Pattern, the 2nd candle is short an looks contained withing the 1st candle.

In the case above, Day 2 was a bullish candlestick, which made the bullish Harami look even more bullish. The size of the second candle determines the pattern's potency; the smaller it is, the higher the chance there is of a reversal occurring. The opposite pattern to a bearish harami is a bullish harami, which is preceded by a downtrend and suggests prices may reverse to the upside.

In other words, for the best results as a reversal candle, look for the bearish harami to appear at the top of an upward retrace in a downward price trend. When price breaks out downward, it rejoins the existing primary trend and price tends to drop. The harami candlestick pattern has trend reversal characteristics. Now that we have covered the basics of the harami candlestick pattern, it’s now time to dive into tradeable strategies.

Understanding a Candlestick Chart – Trading – Investopedia

Understanding a Candlestick Chart – Trading.

Posted: Fri, 11 May 2018 13:40:01 GMT [source]

In the above example, the risk-averse would have avoided the trade completely. The market continues to trade lower to an extent where it manages to close negatively forming a red candle day. A sell signal could be triggered when the day after the bearish Harami occurred, the price fell even further down, closing below the upward support trendline. When combined, a bearish Harami pattern and a trendline break might be interpreted as a potential sell signal.

- This is the power of candlesticks and using various methods to confirm each other.

- On P2 the market unexpectedly opens lower, displaces the bulls, and sets in a bit of panic to bulls.

- The lowest low of the pattern will be the stoploss for the trade.

The above numbers are based on hundreds of perfect trades. We use the information you provide to contact you about your membership with us and to provide you with relevant content. Funded trader program Become a funded trader and get up to $2.5M of our real capital to trade with. Information you provide via this form will be shared with Forest Park FX only as per our Privacy Policy. Once you have your dataset, you can measure your success.

The harami candle of this “cross” continues the trend presented by previous candles. The candle with wicks but without the body signals the drastic market activity drop. The harami cross means that the trend reversal is about to hit. If you spot the harami pattern at the end of the downward chart line, it is a bullish harami signal. The second candle opens at a significantly higher position than the previous candle.

In Chart 2 above, a buy signal could be triggered when the day after the bullish Harami occurred, the price rose higher and closed above the downward resistance trendline. A bullish Harami pattern and a trendline break is a combination that could result in a buy signal. A bearish Harami occurs at the top of an uptrend when there is a large bullish green candle on Day 1 followed by a smaller bearish or bullish candle on Day 2.

What is a Marubozu Candlestick?

A Marubozu Candlestick pattern is a candlestick that has no “wicks” (no upper or lower shadow line). A green Marubozu candle occurs when the open price equals the low price and the closing price equals the high price and is considered very bullish. A red Marubozu candle indicates that sellers controlled the price from the opening bell to the close of the day so it is considered very bearish.

Najnoviji komentari